Whitepapers > Whitepapers2

UMC helps to accelerate and streamline RDN reconciliation activities between KSEI and Administrator Bank RDN

Investors meet their needs

The implementation of (Automatic Reconciliation RDN) is expected to increase the accuracy of information Rekening Dana Nasabah (RDN) or Customer Fund Account which has been seen by investors through the Securities Ownership Reference Application (AKSes).

How UMC could help?

- Makes data reporting easy and practical because it doesn't go through forms etc.

- Efficient, once sent directly to KSEI

Synchronization RDN: Synchronize data from Bank and KSEI

Here is an example scenario that demonstrates how UMC ( Universal Message Converter ) connectivity in financial organizations allows us to make everyday transactions feel easy and natural.

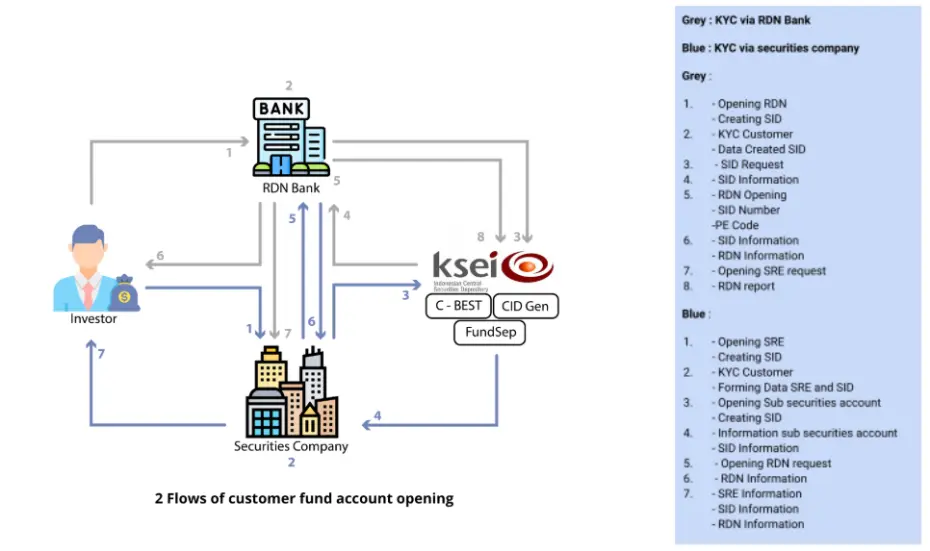

To be able to provide investment product services, a securities company (e.g. PT Mega Capital Sekuritas) requires an account for its customers that is devoted to investment transactions. The account that opens at a bank (e.g. Bank Mega) is called a Rekening Dana Nasabah (RDN). Before trading on the capital market, the account needs to be registered with the authority that regulates investment traffic, Which is KSEI (PT Kustodian Sentral Efek Indonesia). As a registered sign, the Customer will obtain SID (Single Investor Identification) from KSEI.

The process of making RDN can be broken down as follows:

- Prospective Customers (Investors) come to securities companies to invest.

- The securities company opens a Customer Fund Account (RDN) at a bank that has services for that RDN.

- The bank processes the account opening and then registers it with KSEI via SOAP Service. If the conditions are met, KSEI will provide the SID for the customer. Thus the RDN is ready to use.

- If there is a change in customer data that is not related to the transaction, such as a change in address, telephone number, and the like, the securities company can do so through the SOAP Service which is directly connected to KSEI through the Bank serving RDN.

- Every investment transaction data from RDN is reported daily by the RDN management bank to KSEI using a file.

IMPLEMENTATION

Let’s examine this example process on how a Customer Fund Account (RDN in Indonesian) processing application can be implemented using UNCAL ESB.

In this example, we'll utilize a canonical messaging format and the UNCAL ESB product to handle communication and transformation between services.

- Our Rekening Dana Nasabah (RDN) processing is an API and SOAP Based web services

- Creating CIF number and Customer Mutual Fund Account : *REST/API Service*, this process uses API to create an applicant CIF number and account

- Checking or validating Investor/applicant Data : *SOAP Service or REST/API Service* another service that can request and retrieve the applicant account data

- Store Investor/applicant data in data warehouse : *JDBC Database* each and every application received by the bank must be cached into the data warehouse database to comply with regulatory requirements, this component performs a simple insert into an existing database

- Scheduler data transaction/archiving : *SFTP/FTP*, this component can also be used to store data in a file for archiving and can be sent or received using the scheduler